Commercial transactions are the order of the day, so commercial agreements are constantly being made between 2 parties.

In this article we tell you what a commercial contract is, its types, its characteristics and the differences with respect to a civil contract.

What is a commercial contract?

A contract is characterised by the fact that it is an agreement between two parties who undertake to comply with a set of conditions. In the case of the commercial contract – regulated by the Commercial Code – the same applies, but the parties to the agreement are self-employed, entrepreneurs or companies with commercial objectives. Therefore, entering into a commercial contract indicates that a commercial exchange is to take place between two parties, or one party is to provide a service to the other party.

Types of commercial contracts

There are many types of commercial contracts, but the most common are the following:

- Commercial sales contract: one party agrees to give something, or provide a service, and the other party agrees to pay for it. Se trata de uno de los tipos de contratos más comunes.

- Lease contract: one party, the lessor, delivers to the other party, the lessee, the leased property for the time defined in the contract in exchange for money; there is an option to extend.

- Insurance contract: also known as an insurance policy. One party, the insurer, undertakes to provide a benefit to the other party, the insured, as long as he has paid and the previously agreed events occur (fire, traffic accidents, theft, etc.).

- Supply contract: one party undertakes to supply goods or services to the other party on a continuous or periodic basis in return for payment.

- Works contract: one party undertakes to carry out a work for the other party; payment will be made provided that the conditions of the contract are met.

- Agency contract: by means of a contract, a person, called an agent, acts as an intermediary for a company in exchange for remuneration and without assuming any risk in the activities he/she performs.

- Contrato de préstamo y crédito: una entidad financiera presta dinero a la otra parte a cambio de que lo devuelva; se suelen pactar unos intereses. p

- Inland transport contract: one party obliges the other party to carry passengers or goods from one point to another; there is a cost involved.

- A barter contract: both parties agree to exchange a good or service without the need to pay for it.

Characteristics of a commercial contract

Because there are many different types of commercial contracts, each of them has its own characteristics that help to distinguish them from one another. However, these contracts have similar features.

Firstly, there are two parties involved in the commercial contract; normally, one proposes the proposal and the other accepts it. Both must be clearly identified in the contract, so full details must be provided (DNI, NIF, registered office, etc.).

A proposal must then be prepared – either verbally or in writing – and accepted. In case of non-acceptance, the withdrawing party shall indemnify the other party. The reason for this is that, from the moment the contract is created, it is in a stage of perfection, which binds the two parties.

Finally, the contract must be interpreted in good faith, i.e. the drafting party must be trusted to have done so fairly.

In addition to these characteristics, the following aspects of commercial contracts must also be taken into account:

- They are always onerous: both parties have obligations and obtain benefits, as well as act reciprocally.

- They can be executed immediately or after a period of time.

- They are real, valid, formal, meet all the necessary requirements and are created by consensus between the parties.

- They can be principal (when they do not depend on another contract) or accessory (when they depend on another principal contract).

- They stipulate an obligation to give, to do or not to do.

Differences between a commercial contract and a civil contract

The main difference between a civil contract and a commercial contract lies in the outcome of the contract. While the commercial contract seeks to obtain an economic benefit, the civil contract does not have this objective.

In addition, the parts also vary. The commercial contract involves entrepreneurs, companies and self-employed persons; in the civil contract the parties are private persons.

Another major difference between the contracts is the legislation governing them. While commercial law, whose function is commercial, is regulated by the Commercial Code, civil law, which focuses on the civil or private relations of individuals, is regulated by common law, but especially by the Civil Code. Both would answer to the Civil Chamber of the Judiciary.

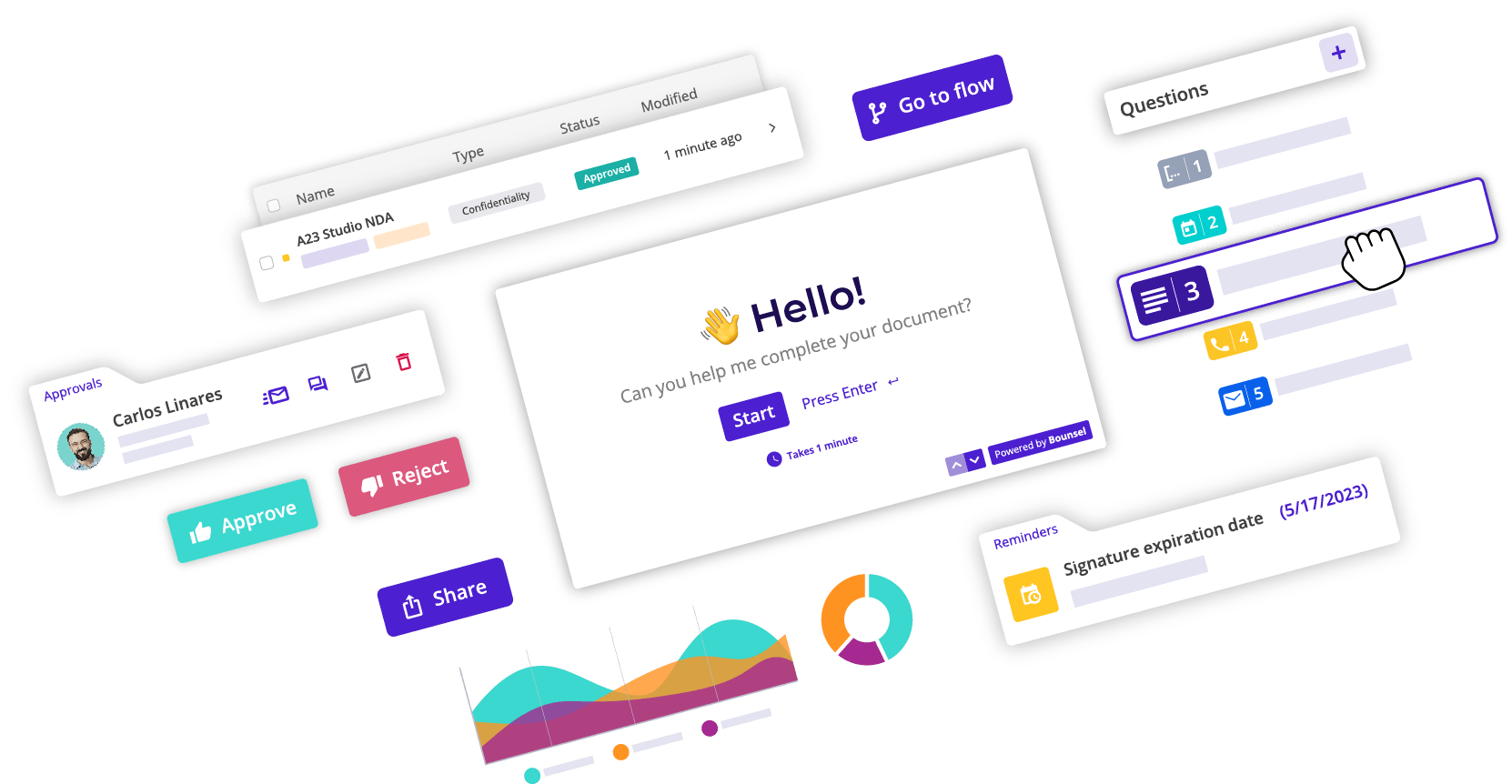

How Bounsel Flow helps you automate the creation of your business contracts

Bounsel Flow is a tool designed by Bounsel that can help you automate your business contracts, whether they are rental contracts, an insurance policy or a sale and purchase.

It is very easy to use, just follow the steps below:

- Upload the template in Word with the fields you need to complete.

- Create an interactive conversational form or, as we call it, a flow.

- Share the ‘flow’ with whoever you want to fill in the form

- Once the form is completed, you will receive the completed documents

Start automating the creation of commercial contracts with Bounsel Flow completely free of charge.